Help

Table of Contents

Get Started

1. Sign up

It’s easy to sign up for Trade Edge.

Simply give us your email address, and then create and confirm a password of your choosing. As ever, pick a password that’s hard for others to guess, and of course one that you’ll remember.

Then click ‘Create account’. Now you’re ready to use Trade Edge.

2. Search for a business

When you log in for the first time, your dashboard page will be empty. That’s because you haven’t chosen to follow any businesses yet.

To get started, pick a business that you trade with. They might be a key supplier that you want to check on, a customer who’s been paying you late, or a prospect you’re hoping to win.

Search for that business using the search bar on the top left hand side of your page. To make it easy, you can search for businesses by:

- Company name

- Registered Company Number

- Registered address

- DUNS number

If more than one business matches your search, scroll through the results to find the one you’re looking for.

3. Company page

Once you’ve found one of the businesses you want to investigate, Trade Edge shows you the following:

SynopsisThis section will give you an overview of the business you’ve searched for, including:

- Registered name

- Incorporation date

- Location

- Credit rating and risk profile

- If applicable, the number and value of CCJs that have been lodged

Here you’ll see the address where this company is registered with Companies House.

Level of RiskHere is where you’ll find the current credit risk rating of this business. You can find an explanation of each rating in the FAQs section.

Trading Payment ParityThis section gives you an idea of how quickly this business pays their suppliers relative to the average time it takes any business to pay suppliers.

For instance, a ‘Trading Payment Parity’ rating of ‘On Time’ means that generally this business pays their suppliers within the invoice payment terms given.

For a more in-depth explanation of this section, see the relevant FAQ.

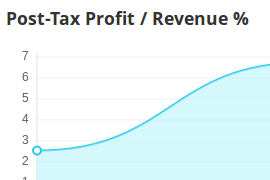

Balance Sheet

This graph will show you the net worth of this company divided by their total assets as a percentage over the last two years’ worth of filed accounts.

This calculation is a commonly used measure of solvency. You can read an explanation of this section in the FAQs section.

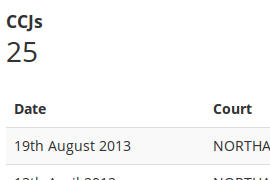

County Court JudgementsIf applicable, here you’ll see the total number and the total value of County Court Judgements (CCJs) awarded against this business.

Each CCJ will be listed below with:

- The date it was given

- Which court awarded it

- The amount

- The status (current or satisfied)

In the right sidebar you’ll see this business’s Company Number, DUNS number and incorporation date. If the information is available from Companies House, we’ll also display a telephone number.

MapYou’ll also be able to see the location of this business’s registered address on a map. If you want, you can zoom in, zoom out or use Google Street View to pin point the business you’re looking at.

Nearby businessesWe think you might be interested in seeing what businesses are local to the one you’ve searched for. It might be that this is a company in an area where you do a lot of trade, and so these could be great prospects or potential suppliers.

Simply click on the links provided to find out more about these nearby businesses.

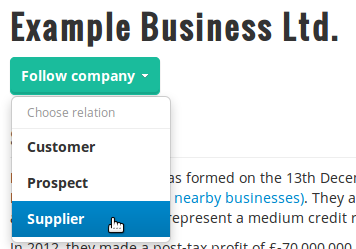

4. Categorise this business

If you want to continue to monitor this business, Trade Edge gives you the option to follow them by category so that they appear on your dashboard.

There are three categories; Customer, Prospect and Supplier.

To follow this business, scroll to the top of the page: underneath the business name there will be a drop down menu displaying ‘Follow company’. Click on that menu and select the relevant category. A green tick will appear to the right of that menu to let you know that you’ve successfully followed this business.

5. Review your dashboard

Click on the ‘Trade-Edge’ logo at the top of this page or the home button next to the search bar to navigate back to your dashboard.

Depending on how many businesses you’ve followed, you’ll have a range of four categories to review.

Recently UpdatedAny business that you’re following which has had recent changes to their credit status will be listed here.

CustomersThis section will display a table of the last five businesses you chose to follow and categorise as customers. You can expand this by clicking the 'Load More' button at the bottom of the table.

The table displays a snapshot of their report:

- Business name

- Company Number

- Level of Risk rating (hover over the icon to display each rating)

- Trading Payment Parity rating

Also displayed is a pie chart showing the ‘Level of Risk’ ratings across every business you’ve categorized as a customer. This chart will give you an overview of what percentage of your customers has a healthy credit risk rating, and what percentage does not.

ProspectsAs ‘Customers’, above, but for the businesses you’ve categorized as prospects.

SuppliersAs ‘Customers’, above, but for the businesses you’ve categorized as suppliers.

FAQs

- FAQs

- I’ve forgotten my password. How can I log in?

- I can’t find the business I’m looking for- help!

- We trade with a foreign company- can I find them on Trade Edge?

- What’s a Company Number?

- What’s a DUNS number?

- The address shown isn’t the same as the company’s office- is that right?

- What does the ‘Level of Risk’ rating mean?

- The ‘Level of Risk’ rating given here is different to the credit score I’ve seen elsewhere. Why is that?

- This business report says that no Trading Payment Parity information is available. Why not

- What’s Trading Payment Parity and how do you know about it?

- What’s a County Court Judgement (CCJ)?

- I’ve accidentally categorised a supplier as a customer- can I change that?

- How do I ‘unfollow’ a business?

1. I’ve forgotten my password. How can I log in?

Don’t panic! When you get to the log in page, just click on ‘Forgot your password’. Then give us the email address you used to sign up and we’ll send you a change password request.

You’ll need to go to your inbox, open our email and then follow the instructions to reset your password.

2. I can’t find the business I’m looking for- help!

There are a few reasons why you might not be able to find the business you’re looking for- that’s why we’ve made it possible to search by company name, Company number, DUNS number or address.

If you know the business’s Company number or DUNS number, try searching by one of those. They’re both unique identifiers and so should give you the best chance of a match.

Otherwise, try searching by the company’s full name or address, then if there are many matches scroll through the list to find the best match.

Also, bear in mind that some businesses use a different trading name to the one listed at Companies House- you’ll need to search for the registered company name to find them.

3. We trade with a foreign company- can I find them on Trade Edge?

Red Flag Alert provides all the data displayed here (you can read more about them on our About page).

Red Flag Alert only holds records on UK companies and sole traders, not international firms. You won’t be able to use Trade Edge to credit check companies from outside the UK.

4. What’s a Company Number?

A Company Number is a unique identifier specific to the UK as it’s assigned to a business when they register at Companies House.

5. What’s a DUNS number?

A DUNS (Data Universal Numbering System) number is a unique identifier assigned by Dun and Bradstreet, an international business information supplier.

6. The address shown isn’t the same as the company’s office- is that right?

Many businesses use a separate address to register at Companies House than they do day-to-day.

Trade Edge displays the location of a business’s registered address, and so that might be different to the shop, office or factory that perhaps you’ve visited or seen on their website.

7. What does the ‘Level of Risk’ rating mean?

|

3 Red Flags

For any concern carrying three Red Flags no credit terms should be offered or trading undertaken and a full disclosure of the situation should be obtained. |

|

|

2 Red Flags

These are businesses that have a poor credit score or where serious detrimental information has been identified. Trading with these concerns is very high risk. |

|

|

1 Red Flag

These businesses will be higher credit risks due to their financial results, past trading history, lack of information or may have detrimental information against them. They could be slow in paying their suppliers and it is recommended that any trading undertaken be supervised carefully. All monitoring notices received should be reviewed immediately and acted upon quickly. |

|

|

Amber

Amber businesses have passed the lower threshold of the credit score algorithms and are either very new, display some financial, payment or filing characteristics that make them an elevated risk. They should be treated cautiously and all monitoring notices reviewed carefully. |

|

|

Bronze

Bronze companies will be an average credit risk whose financial position and trading results are not as strong as Silver companies. They may even be new companies that have yet to file their accounts. It is likely that not all payments are made to terms and it is advisable to review any monitoring notices received on these companies. |

|

|

Silver

Silver companies will usually be well managed and established businesses in a sound financial position and with satisfactory trading results. They are likely to pay suppliers reasonably well and can be regarded as good credit risk. |

|

|

Gold

Gold companies will have traded for many years, have strong balance sheets, excellent trading results, are likely to pay suppliers to terms and have an unblemished credit history. Trading with Gold companies can normally be undertaken with complete confidence. Typically these would be quoted companies, large private groups or been trading successfully for a number of years. |

|

|

Unknown

The level of risk for this company is unknown. |

|

|

Not Trading

The level of risk for this company is unknown. |

|

|

Insolvent

Company has undergone some form of Insolvency. All credit transactions should be stopped. |

8. The ‘Level of Risk’ rating given here is different to the credit score I’ve seen elsewhere. Why is that?

Red Flag Alert provides all the data displayed here (you can read more about them on our About page).

While the vast majority of the information collected by Red Flag Alert is identical to that of other business information databases, Red Flag Alert have their own algorithms that produce their own credit risk rating system (see above for details).

That means that there may be differences in the way Red Flag Alert and other suppliers display credit risk ratings.

9. This business report says that no Trading Payment Parity information is available. Why not?

Red Flag Alert provides all the data displayed here (you can read more about them on our About page).

While Red Flag Alert holds this information on a huge number of UK companies, it is not always available for every business, and so it might not appear on our reports.

10. What’s Trading Payment Parity and how do you know about it?

The ‘Trading Payment Parity’ rating shows whether this business generally pays their suppliers early, on time, or late. To produce this rating, Red Flag Alert looks at when supplier invoices are paid, in relation to when they are due to be paid.

This kind of rating is made possible through many data sources, including some large utility suppliers sharing payment information with companies like Red Flag Alert.

11. What’s a County Court Judgement (CCJ)?

A County Court Judgement (CCJ) can be given to a business if they owe any supplier money and have been unable or unwilling to pay. It shows that the court has formally decided that the business is in debt to their supplier.

If a business has CCJs to its name it can be an indication of credit risk.

Records of CCJs are kept for six years unless the full amount is paid within one month. Thereafter, a CCJ can be marked as ‘satisfied’ if the full amount is paid.

You can see which court has granted the CCJ in Trade Edge. If Northampton County Court is listed, the CCJ was probably awarded online.

12. I’ve accidentally categorised a supplier as a customer- can I change that?

Yes! Simply navigate to that business’s page, and click on the drop down list where ‘customer’ is currently displayed.

If you select ‘supplier’, we’ll change that business’s category. It’s as easy as that!

13. How do I ‘unfollow’ a business?

If you no longer want to follow a business, navigate to their company page and hover over the green tick that’s displayed underneath the company name. It’ll ask if you want to ‘unfollow’- just click on that button and this business will no longer feature on your dashboard.